Tools for Member Self Service- Vehicle Loans

Problem Statement

Vehicle loan borrowers at OCCU (an Oregon-based credit union) needed help enrolling in eStatements to satisfy a requirement to receive a discounted loan rate and avoid fees. Prior to this project, borrowers had to contact the call center and have an employee set up their enrollments. Our call center was overwhelmed and borrowers were often skipping the enrollment process because they didn’t realize they needed to call in, leading to frustration and fees.

We sought to solve these problems by designing & developing a tool to better serve these members by automating eStatement enrollment, bypassing negative first impressions, and reducing incoming call volume.

Role & Team

The team consisted of 5 core members: the Director of Digital Experience, 2 UX designers, a software developer, and the account representative for our 3rd party vendor. As the lead UX designer on the team, I also acted as the project manager and main contact between our vendor and the credit union. I consulted with our marketing and compliance teams at various points of the project, to get approval and input on disclosures and content, as well as visual design and stylistic choices.

Post-launch, I continue to monitor performance and troubleshoot technical issues with our vendor, internal developers, and member-facing employees. We have also entered Phase 2 of our work with this vendor and I continue to work on designs for new campaigns to help brand new members engage with their new accounts.

Goals

Reduce call volume and time spent helping borrowers with enrollment.

Automate the enrollment process.

Provide better service to members by making it easier for them to meet the qualifications for rate discounts.

Increase the number of members enrolled in eStatements while decreasing the time it takes to enroll.

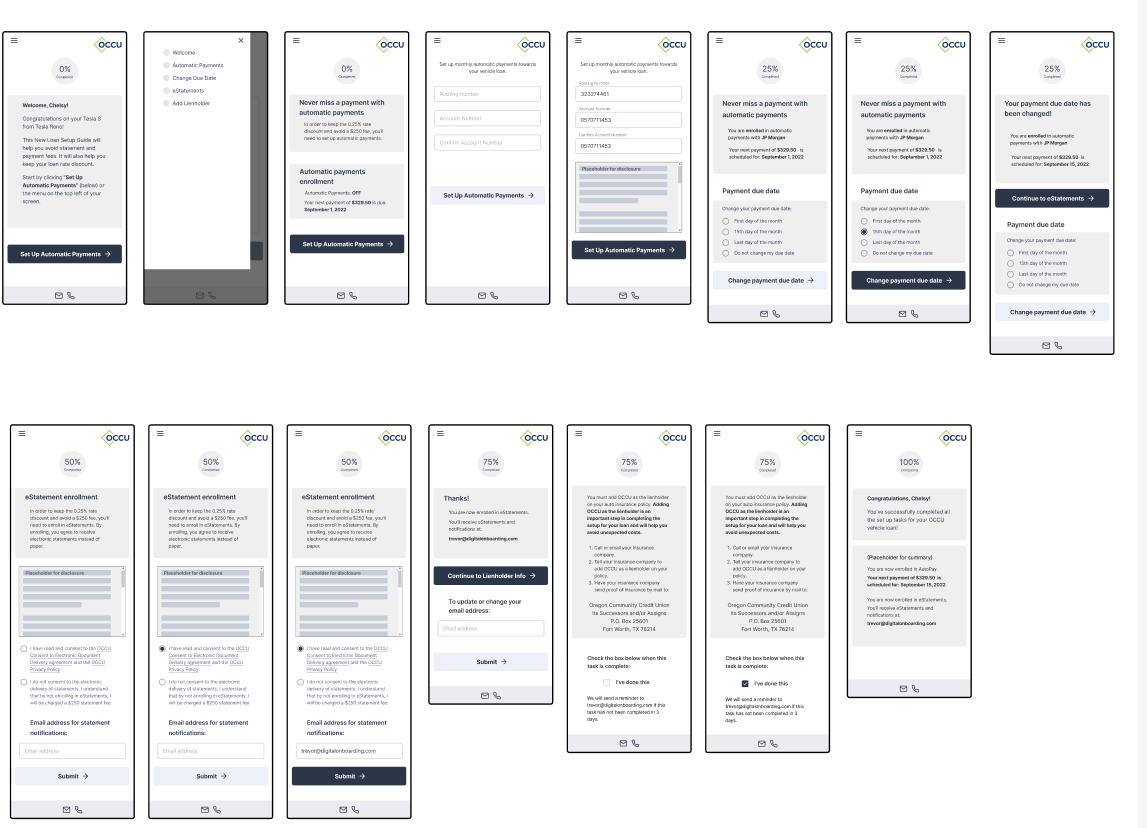

Wireframes

Small sample of wireframes from the main campaign. We went through several rounds of testing and iterations, finally arriving at a cohesive flow that helped members accomplish the tasks they needed to.

Compliance & regulations

One of the most interesting aspects of working in the financial industry is the high level of regulation. Designs and products not only need to meet user and business needs- they also need to adhere to strict compliance and regulatory standards.

In this project, we encountered a design and compliance issue regarding enrollment disclosures. Our 3rd party vendor had an enrollment widget that unfortunately did not meet our compliance and legal requirements. I was able to work closely with our vendor’s product team to redesign the enrollment widget, resulting in an improved (and compliant) experience that was then rolled out to our vendor’s other customers.

Member Impact & KPIs

Member impact and engagement were measured via:

% increase of members adopting eStatements: 50% increase after launch

length of time to enroll: 63% reduction in time to enroll

call volume: due to a phone system change that occurred simultaneously, we unfortunately lost the ability to compare pre-project call volumes to post-launch call volumes. Anecdotally, the call center reps report a steep decline in calls regarding enrollment.

What’s next?

I continue in my role as lead designer and project manager. I am currently working closely with our developer to revise the API setup and improve data integrity and set us up for better reporting capabilities in the future. I am also collaborating with our marketing team on the design of new campaigns to help onboard new checking account members.

I will continue to monitor KPIs and iterate on the tools already created, making improvements and changes as needed.

Deliverables: SMS & email campaigns

Role: UX Designer & Project Manager

When: 2022- present

Tools: Figma, Digital Onboarding, UserZoom